The Ultimate Revolut Review for Australians: Everything You Need to Know

Average Reading Time: 7min.

Table of Contents

- Introduction: What is Revolut and Why is it Popular?

- Chapter 1: Breaking Down the Costs: Which Plan is Right for You?

- Conclusion

What is Revolut and Why is it Popular?

Established in 2015 by the visionary duo Nik Storonsky and Vlad Yatsenko in the UK, Revolut has quickly evolved into a global leader in financial technology. From its inception, the company focused on revolutionizing the way individuals and businesses handle their finances by providing a seamless, user-friendly platform. Since its launch in Australia in 2019, it has attracted a growing customer base, currently serving over 40 million personal customers worldwide and more than 500,000 business clients.

The company's mission is to allow users to manage all aspects of their financial lives—from spending and saving to investing and borrowing—efficiently and conveniently within just a few taps. This accessible approach not only appeals to tech-savvy users but also resonates with frequent travelers, making Revolut an attractive option for Australians dealing with their finances both domestically and internationally.

Why Australians are Turning to Revolut

Australians are increasingly flocking to Revolut, attracted by its competitive features and affordability. Here are some reasons behind this fintech's rising popularity:

Global Transfers: Revolut enables international transfers in over 30 currencies to 150 countries, providing a cost-effective way for users to send money globally.

No Hidden Fees: With the ability to withdraw cash from ATMs without incurring hefty fees within certain limits, Revolut outperforms traditional banks that often charge significant withdrawal fees.

Diverse Currency Management: The app allows users to hold, exchange, and even spend in multiple currencies, making it a perfect fit for travelers and expatriates.

Customer-Centric Features: The availability of real-time notifications, advanced security measures, and the option to pause cards instantly have garnered positive feedback from customers seeking control and peace of mind.

Flexible Plans: With a Free Standard Plan and enhanced features available in Premium and Metal plans, users can choose plans that fit their lifestyle and financial practices.

Key Statistics Behind Revolut's Growth

The sheer numbers reflect Revolut’s expanding footprint in Australia and beyond. Here are some noteworthy statistics:

Personal Customers: 40+ million

Business Customers: 500,000+

Active Users in Australia: Growing exponentially since 2019

According to reports, customers appreciate Revolut's ease of use when performing transactions. However, as with any service, the platform hasn't been without its criticisms; some users cite frustrations with customer support and account access issues. Notably, it holds a rating of 2.3 out of 5 stars based on 139 reviews on productreview.com.au, prompting ongoing improvements in customer service response times.

A Word from the Top

Reflecting on Revolut's mission, CEO Nik Storonsky stated,

“The future of banking is digital, and Revolut is leading the charge.”

This vision underpins the innovative technologies and features that users have come to expect from this rapidly evolving fintech, and it highlights the importance of adaptability in today's financial landscape.

The Unique Selling Proposition of Revolut in Australia

What sets Revolut apart in the competitive Australian market? Here are some defining characteristics:

Comprehensive Financial Services: Beyond simple banking, Revolut encompasses advanced services including stock trading, cryptocurrency investments, and even commodities, allowing users to diversify their portfolios from one platform.

User-Friendly Interface: Designed with the user in mind, the mobile app is simple to navigate, ensuring that even those new to digital banking can find it intuitive and easy to manage their finances.

Real-Time Spending Notifications: Users benefit from instant transaction alerts, fostering a financial discipline that traditional banks rarely provide.

Innovative Features: Services like “Pay All Fees” for international transactions and the ability to change currency on demand cater to the needs of travelers managing multiple currencies, ensuring they remain in control of their finances.

Options for Younger Audiences: Revolut offers accounts for those under 18, providing a financial learning platform that educates the next generation on managing money responsibly.

As of October 2023, Revolut continues to enhance its offerings to cater to its diverse user base, making it an appealing choice for Australians seeking tech-forward banking solutions.

Challenges and Customer Feedback

While Revolut's rise has been meteoric, some challenges need addressing. Customer complaints often center around account restrictions and difficulties in accessing customer service, leading to occasional dissatisfaction among users. Balancing robust security measures with customer service is vital for Revolut as it strives to grow its Australian user base.

Successful Experiences: Many users laud the platform for its efficiency, especially highlighting successful currency exchanges and international transaction ease.

Areas for Improvement: A consistent theme in reviews involves requests for more responsive customer support, emphasizing the need for a streamlined assistance channel to enhance user experience.

Revolut's significant progress in Australia and around the world is a testament to the demand for digital banking solutions that offer flexibility and control. By continually refining its services and listening to user feedback, Revolut is well-positioned to further enhance its reputation as a preferred fintech solution.

As Revolut continues to innovate and expand its offerings, one thing is certain: the future of digital banking is here, and it is being shaped by pioneers like Revolut.

Breaking Down the Costs: Which Plan is Right for You?

The rise of fintech solutions like Revolut has transformed the way users interact with their finances. More than just a mobile app, Revolut offers a plethora of services, and understanding the costs associated with its various plans is crucial for potential users to make informed decisions. Let's delve into the specifics of its personal accounts—the Standard, Premium, and Metal plans—while exploring transaction fees, ATM withdrawal limits, and how to select the plan that best suits individual financial habits.

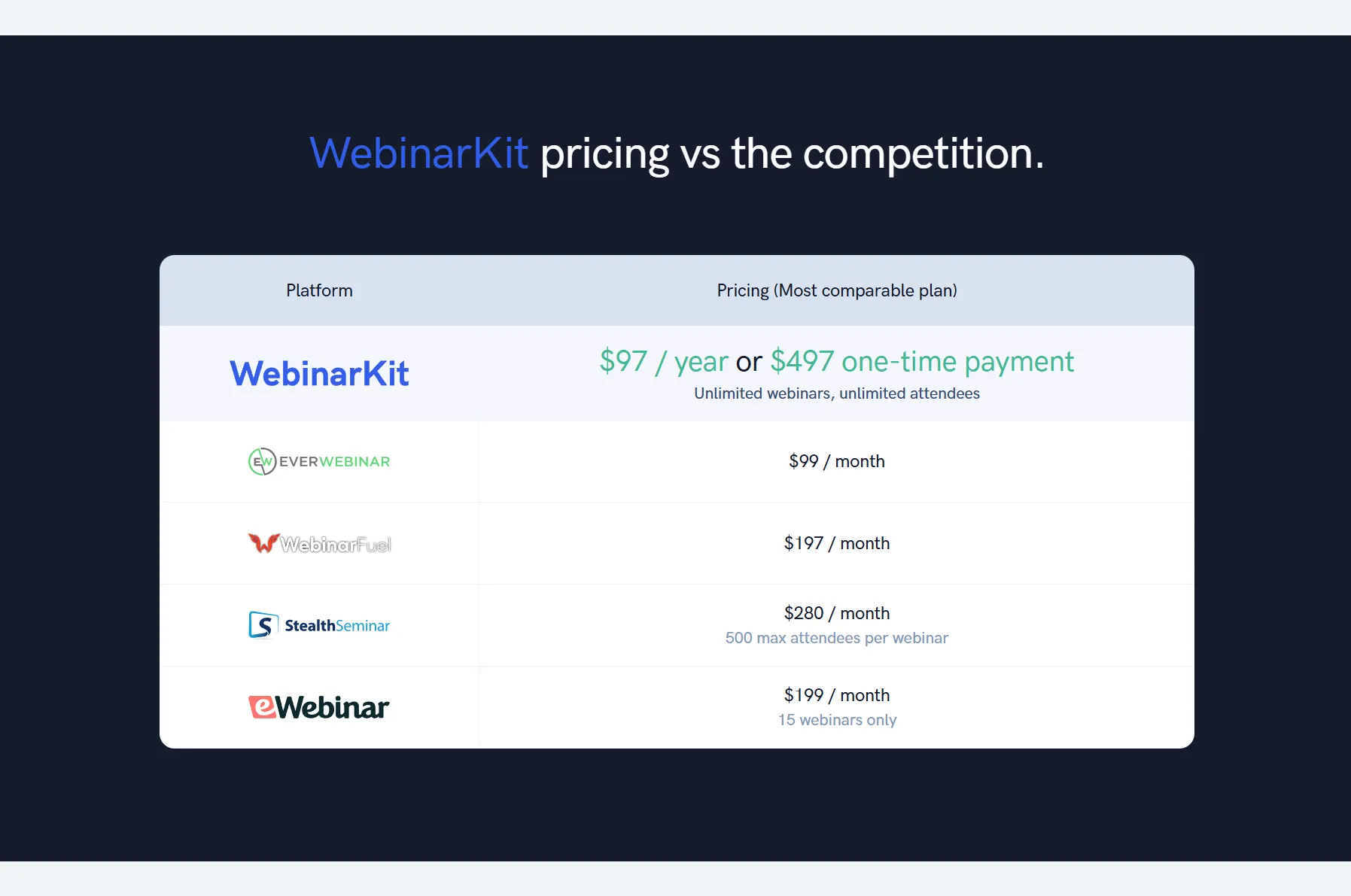

Understanding Revolut Plans

Revolut presents three tiers of accounts: the Standard Plan, which is free; the Premium Plan at $9.99 per month or $99 a year; and the Metal Plan at $24.99 monthly or $225 annually. While the Standard Plan serves as an accessible entry point for individuals, the Premium and Metal plans cater to users seeking additional benefits.

Standard Plan

The Standard Plan is ideal for casual users and those starting their financial journey with digital banking. It provides essential services such as the ability to hold multiple currencies, perform international transactions, and access the Revolut marketplace. However, users must be mindful of certain limits. For example, ATM withdrawals are capped at $350 per month, and exceeding this allowance incurs a charge of 2% of the withdrawal amount.

Premium Plan

The Premium Plan is tailored for more frequent travelers seeking enhanced features. This plan not only expands the ATM withdrawal limit to $700 monthly but also offers advantages such as reduced international payment fees by 60%, priority customer support, and access to exclusive financial tools. This tier also includes five commission-free stock trades, aligning perfectly with users who are beginning their investment journey.

Metal Plan

For those who desire the ultimate Revolut experience, the Metal Plan is the pinnacle of what the app offers. Monthly ATM withdrawal limits rise to an impressive $1,400. Additionally, users gain significant benefits such as 80% off international payment fees, cashback on card payments, and ten commission-free stock trades. The stylish metal card is a standout feature that appeals to consumers who appreciate premium aesthetics alongside their banking services.

Detailed Overview of Fees

Understanding the fee structures associated with each plan is vital for users to avoid unexpected charges. Here’s a quick comparison of the various fees applicable to each account:

Feature Comparison

Standard Plan:

- Monthly Fee: $0

- ATM Withdrawal Limit: $350

- International Payment Fee Discount: N/A

- Card Replacement Fee: $8.99 to $79.99

Premium Plan:

- Monthly Fee: $9.99 or $99/year

- ATM Withdrawal Limit: $700

- International Payment Fee Discount: 60%

- Card Replacement Fee: $8.99 to $79.99

Metal Plan:

- Monthly Fee: $24.99 or $225/year

- ATM Withdrawal Limit: $1,400

- International Payment Fee Discount: 80%

- Card Replacement Fee: $8.99 to $79.99

Choosing the right Revolut plan depends heavily on an individual's financial habits and lifestyle. Here are some tailored suggestions:

Frequent Travelers: Consider opting for the Premium or Metal plan. With higher ATM withdrawal limits and reduced fees on international transactions, users will find their travel experiences more pleasant and cost-effective.

Casual Users: The Standard Plan is a great starting point. With no monthly fee and essential functionalities, it's perfect for users testing the waters of digital banking.

Investors: If trading stocks is part of your financial strategy, the Metal Plan stands out with its ten commission-free trades and premium features that enhance the investment experience.

Fees Associated with Transactions and Withdrawals

Beyond the membership fees, users must also be aware of other costs that may arise from transactions, especially when using credit cards to fund their accounts. Here are some specific fees that may be encountered:

When loading money onto your Revolut account, fees are incurred based on the source:

Fees for Adding $500

- Bank Account: $0

- Australian Prepaid or Debit Card: $0

- Australian Credit or Corporate Card: $5

- Foreign Prepaid or Debit Card: $10

- Foreign Corporate Card: $12.50

It’s crucial to consider the cost structure in future financial planning. Missing out on understanding these fees can lead to unwarranted expenses.

Feedback from Users

The testimonials from existing Revolut users shed light on real-world experiences. A finance expert once noted,

"Investing in the right Revolut plan can save you money in transaction fees internationally."

Meanwhile, from a traveler’s viewpoint, one user stated,

"Navigating the fees can seem overwhelming, but choosing the right tier makes all the difference."

This feedback highlights the importance of selecting a plan that aligns with one’s travel frequency and financial behaviors to maximize benefits.

Conclusion

Ultimately, the Revolut platform offers a comprehensive suite of features that can cater to diverse financial needs, whether for casual users or seasoned investors. As users weigh their choices, they should consider their spending habits, frequency of international transactions, and investment strategies. The key takeaway is to choose a plan that not only meets current needs but also supports financial aspirations moving forward.

Whether it’s the free yet functional Standard Plan or the feature-rich Metal Plan tailored for frequent travelers and investors, Revolut ensures that there’s an option available for every wallet. Embracing a digital banking solution like Revolut can streamline financial management and introduce transparency in costs, enabling Australians to make the most of their money.

For more information on Revolut, you can check out the following URL:

- Website: https://www.revolut.com

P.S. Don't forget to follow us on social media, the community, the website and the - - YouTube channel for even more inspiration and updates!

- Website: https://thereviewshed.cc

- Website: https://van-santen-enterprises.com

- Community: https://community.van-santen-enterprises.com

- Marketing Courses: https://thetraininghub.cc

- The Store: https://van-santen-enterprises.cc

- YouTube Channel: @VanSantenEnterprises

To Learn more about "Digital Marketing" or to stay informed, subscribe to the free newsletter or community.

Revolut, #RevolutAustralia, #RevolutReview, #RevolutForAustralians, #RevolutFinancing, #RevolutBankingPlans, #RevolutBankAustralia

TL;DR: Understanding the costs and features of Revolut's Standard, Premium, and Metal plans is essential for choosing the right account. The free Standard Plan is great for casual users, while the Premium and Metal plans offer more advantages for frequent travelers and investors. Be mindful of transaction fees to avoid unexpected costs, and choose a plan that aligns with your financial habits.